简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trump’s “Tariff Tactic” Pushed to the Limit: A Major Shift in Global Order on the Horizon

Abstract:In previous commentary, we noted that Trumps first term was marked by the absence of major wars. Compared with the Biden administration, relations with both North Korea and the Middle East were relati

In previous commentary, we noted that Trumps first term was marked by the absence of major wars. Compared with the Biden administration, relations with both North Korea and the Middle East were relatively cordial. Trump has repeatedly criticized previous presidents for engaging in “endless wars,” such as those in Iraq and Afghanistan. His preference has been to withdraw troops and reduce overseas military deployments.

Trump is not a career politician; he comes from a business background. He values cost-effectiveness, and in his eyes, war is an unprofitable “investment.”

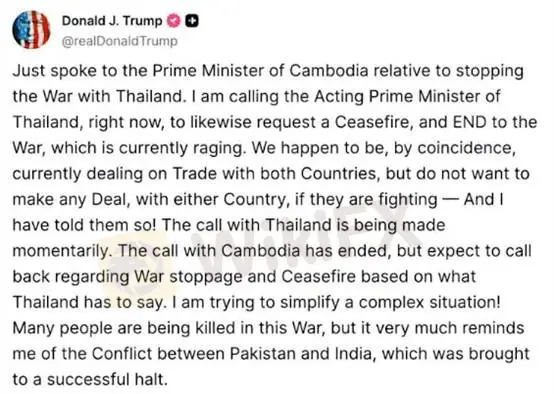

Recently, following skirmishes between Thailand and Cambodia, Trump publicly called for an immediate ceasefire, warning that failure to stop the conflict would jeopardize any trade agreements with the United States.

(Chart 1: Trump posts ceasefire call for Thailand and Cambodia on social media; Source: Truth Social)

Beyond Southeast Asia, Trump has also issued an ultimatum on the protracted Russia-Ukraine war. On Tuesday, he declared that starting today, the U.S. will impose tariffs on Russia for the next 10 years along with additional measures.

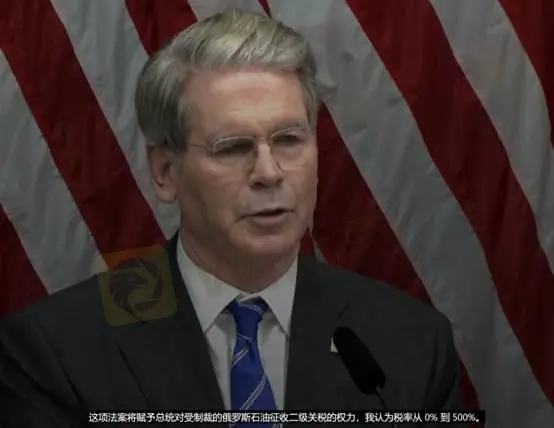

Besant noted that the secondary tariff bill would allow tariffs on Russian oil ranging from 0% to 500%, and expressed confidence that allied nations would follow suit.

(Chart 2: Treasury Secretary Besant discusses secondary tariffs; Source: Reuters)

Aside from geopolitical developments, investors are most focused on the progress of U.S.–China trade talks.

Besant stated that Washington will continue consultations with Beijing on the tariff truce agreement set to expire in two weeks.

So far, sentiment remains cautiously optimistic—much like during the 2018 U.S.–China trade talks. As long as dialogue and meetings continue, tensions should gradually ease. Accordingly, risk assets and global trade dynamics should not be viewed from the most pessimistic perspective.

With geopolitical risks largely priced into markets, attention returns to U.S. macroeconomic data, which can provide clues for the Feds outlook on the labor market at its upcoming policy meeting.

(Chart 3: Job Openings vs. Unemployment; Source: MacroMicro)

As shown in Chart 3, the latest ratio of job openings to unemployed persons stands at 1.07—meaning there are roughly 1.07 job opportunities per job seeker. This steady balance suggests wage growth will likely remain moderate and under control.

From another angle, while AI-driven productivity gains are impacting white-collar jobs, if monetary policy shifts from neutral to accommodative and the ratio trends higher, it would signal the economy is moving from its current state toward a more vibrant expansion.

Conclusion: With global tensions gradually easing, the U.S. economic structure remaining stable, and consumer demand potentially softening in the second half, the rapid expansion of commercial AI and the resilience of SMEs could help them weather near-term headwinds. Looking ahead to 2026, broader market participation in a bull cycle appears likely.

Gold Technical Analysis

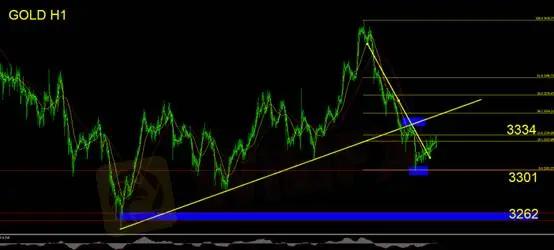

From a technical standpoint, gold has rebounded from the 3,300 level to a recent high of 3,334. With the Fed meeting scheduled for tomorrow, investors holding short positions are advised to close out to manage risk. At present, the move is insufficient for Fibonacci retracement analysis.

Reviewing momentum indicators, the MACD histogram remains in positive territory, while the 5-day moving average shows resistance near 3,334. Ahead of the FOMC decision, we expect gold to trade in a sideways consolidation at lower levels.

Support: 3,301 / 3,262

Resistance: 3,334

Risk Disclaimer: The above views, analysis, research, prices, or other information are for general market commentary only and do not represent the position of this platform. All readers must bear their own risks. Please trade with caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Euro zone inflation holds steady at higher-than-expected 2% in July

Forex Success Stories: Lessons You Can Use to Win

Scam Alert: FCA Issued Warning! Check the List of Unauthorized Brokers Below!

FCA Forex Trading Regulations Explained – What Every Trader and Broker Must Know

FIBO Group: A Closer Look at Its Licenses

Making Money with Forex Weekend Trading

Interactive Brokers Expands Forecast Contracts to Europe

Robinhood Gains 2.3M New Accounts, Platform Assets Close to $280B

CVS shares pop on earnings beat and outlook, as retail pharmacy and insurance units improve

CNBC's Inside India newsletter: Why an India-U.K. trade deal does not make U.S.-India agreement any easier

Currency Calculator