简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HIBT Exchange Accounts and Fees in 2025

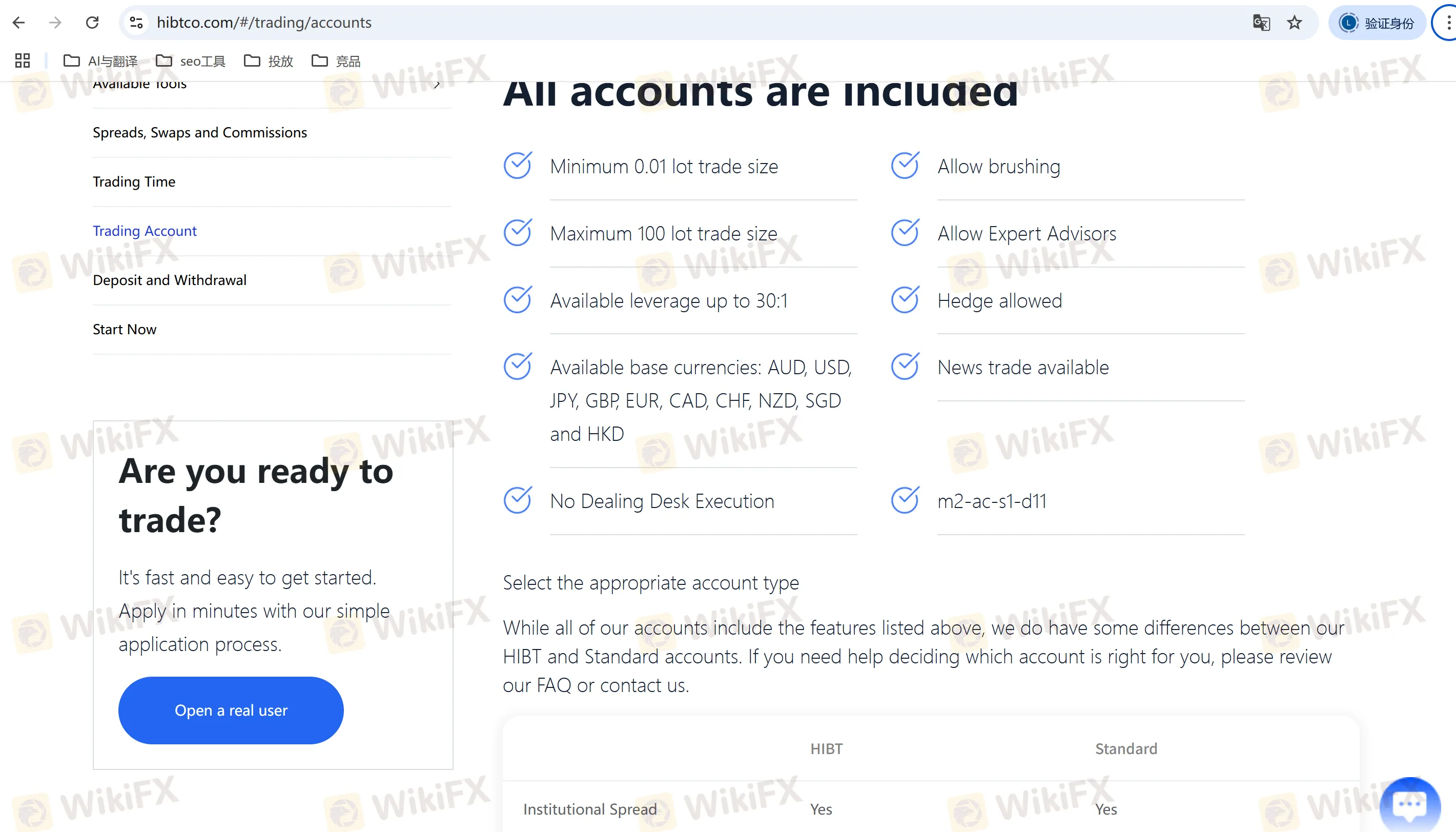

Abstract:HIBT offers different account types designed for various trading needs, including standard and raw spread accounts. Each account comes with unique features, such as the option for leverage and access to demo or Islamic accounts. In this section, we will explore the types of trading accounts available at HIBT, their corresponding features, and the fees associated with each account, including commission, spreads, swap rates, and bonuses.

Trading Accounts

HIBT provides multiple account types tailored to different traders. The available accounts offer varying spreads, commission structures, and leverage options to suit both beginners and experienced traders. Below is an overview of the trading accounts and their key features:

| Account Type | HIBT Account | Standard Account |

| Institutional Spread | Yes | Yes |

| Average EUR/USD Spread | 0.0 - 0.3 points | 1.1 points |

| Commission | From 7 AUD per 100,000 bilateral transactions | $0 |

| Rollover Swap | See your trading platform for market prices | See your trading platform for market prices |

| Most Suitable For | Scrapers and Algorithmic Traders | New Traders |

Trading Fees

HIBT's fee structure includes both trading fees, such as spreads and commissions, and non-trading fees. The brokers spreads start as low as 0.0 pips for raw spread accounts, and commissions are applied to specific accounts. Swap rates and bonuses are also part of the fee structure. Below is a detailed breakdown of the trading fees:

| Fee Type | Details |

| Minimum Spread | 0.0 pips |

| Commission | 7 AUD per 100,000 transactions (HIBT account) |

| Swap | / |

| Bonus | / |

Please refer to the Deposit and Withdrawal Information page for further details on related fees.

FAQ: What You Want to Know Most?

Q1: What is the maximum leverage at HIBT?

A1: HIBT offers maximum leverage of 1:30 across all account types. This is suitable for traders with a moderate risk tolerance.

Q2: Does HIBT offer a demo account?

A2: Yes, HIBT provides a demo account, allowing traders to practice and familiarize themselves with the platform's features before trading with real money.

Q3: What account types does HIBT offer?

A3: HIBT offers the HIBT Account, Standard Account, and Islamic Account, with varying spreads, commissions, and features tailored to different trading preferences.

Q4: What are the detailed fees of HIBT?

A4: HIBT charges a commission of 7 AUD per 100,000 transactions for the HIBT account, while the Standard account is commission-free. The spreads start from 0.0 pips.

Q5: Does HIBT offer an Islamic Account?

A5: Yes, HIBT offers an Islamic Account, which is available upon request for traders who need to comply with Islamic finance principles.

Q6: What is the spread of HIBT?

A6: The spread for the HIBT account starts from 0.0 pips, while the Standard account offers spreads starting from 1.0 pips.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Euro zone inflation holds steady at higher-than-expected 2% in July

Forex Success Stories: Lessons You Can Use to Win

Scam Alert: FCA Issued Warning! Check the List of Unauthorized Brokers Below!

FCA Forex Trading Regulations Explained – What Every Trader and Broker Must Know

FIBO Group: A Closer Look at Its Licenses

Making Money with Forex Weekend Trading

Interactive Brokers Expands Forecast Contracts to Europe

Robinhood Gains 2.3M New Accounts, Platform Assets Close to $280B

CVS shares pop on earnings beat and outlook, as retail pharmacy and insurance units improve

CNBC's Inside India newsletter: Why an India-U.K. trade deal does not make U.S.-India agreement any easier

Currency Calculator