简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

PU Prime Account Types: Demo Account and Leverage Explained

Abstract:Explore PU Prime account types, including demo account options, leverage settings, and requirements. Detailed comparison of Standard, Prime, Cent, ECN & Islamic accounts.

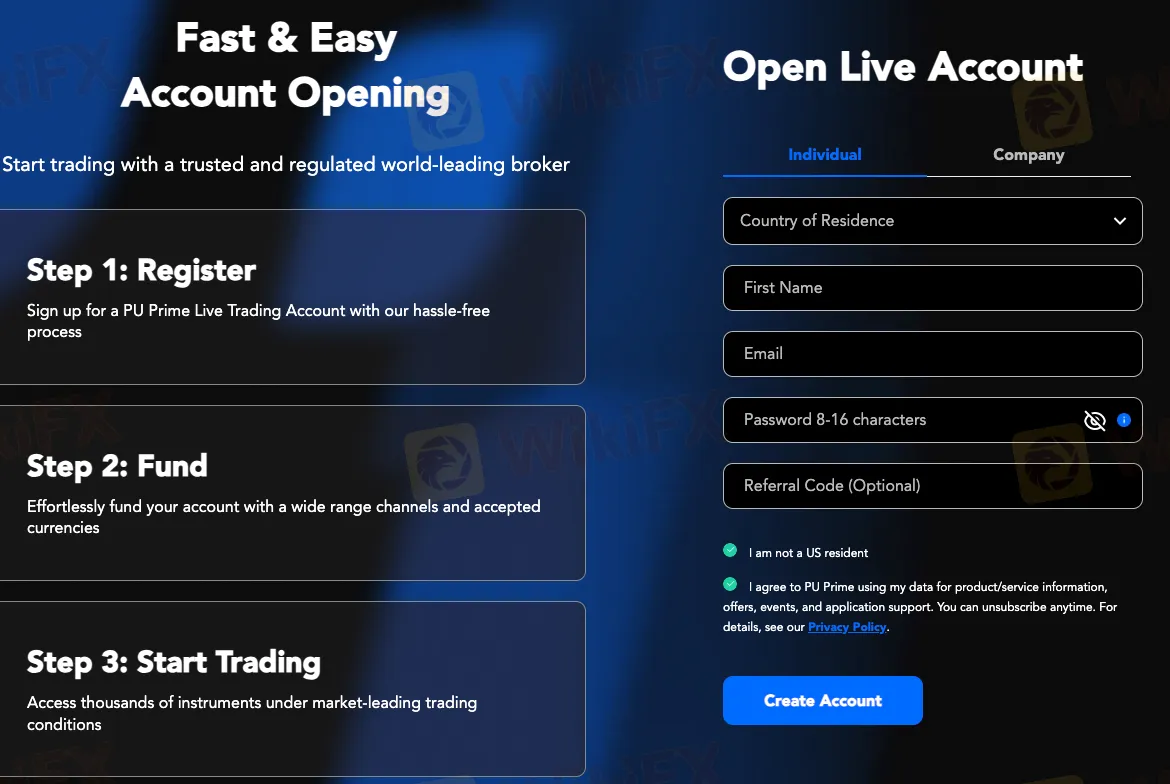

What Account Types Does PU Prime Offer?

PU Prime provides five core account tiers designed for traders at all levels: Demo, Cent, Standard, Prime, and ECN, alongside swap-free Islamic accounts. Key variations include minimum deposits, spreads, commissions, and leverage structures.

Account Specifications: Minimum Deposit, Spreads & Leverage

| Account Type | Min. Deposit | Spread From | Commission | Max Leverage | Islamic |

|---|---|---|---|---|---|

| Demo | – | Demo quotes | – | – | – |

| Cent | $20 | ≈1.3 pips | None | 1:500 | Yes |

| Standard | $50 | ≈1.3 pips | None | 1:500 | Yes |

| Prime | $1,000 | 0.0 pips | $3.5/side | 1:500 | Yes |

| ECN | $10,000 | 0.0 pips | $1/side | 1:1,000 | Yes |

Key Features:

- Prime & ECN: Ultra-tight spreads + transparent commissions (optimal for scalping/algo strategies).

- Cent & Standard: Entry-level access with commission-free trading.

- Islamic accounts: Swap-free compliance (overnight interest waived).

- Maximum leverage: 1:1,000 exclusively for ECN Forex/Gold trades.

Account FAQs

Q1: What demo account options are available?

A1: PU Prime provides demo accounts with virtual funds (~US$100,000) for risk-free trading practice.

Q2: Which account type offers the lowest costs?

A2: ECN accounts deliver the tightest spreads (from 0.0 pips) and lowest commissions (US$1 per side), making them the most cost-efficient choice.

Q3: Is leverage adjustable?

A3: Yes. Clients can manually adjust leverage levels up to each accounts limit (e.g., 1:1,000 for Forex/Gold via ECN).

Q4: Margin call/stop-out levels?

A4: Standardized at 50% (margin call) and 20% (stop-out).

Q5: Are swap-free (Islamic) accounts available?

A5: Yes. PU Prime offers Islamic accounts complying with Sharia law, charging no overnight swap fees.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Euro zone inflation holds steady at higher-than-expected 2% in July

Forex Success Stories: Lessons You Can Use to Win

Scam Alert: FCA Issued Warning! Check the List of Unauthorized Brokers Below!

FCA Forex Trading Regulations Explained – What Every Trader and Broker Must Know

FIBO Group: A Closer Look at Its Licenses

Making Money with Forex Weekend Trading

Interactive Brokers Expands Forecast Contracts to Europe

Robinhood Gains 2.3M New Accounts, Platform Assets Close to $280B

CVS shares pop on earnings beat and outlook, as retail pharmacy and insurance units improve

CNBC's Inside India newsletter: Why an India-U.K. trade deal does not make U.S.-India agreement any easier

Currency Calculator