简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trade.com Broker Regulated and Legit – Full Safety Overview

Abstract:Discover if Trade.com broker is regulated and legit. Learn about its CySEC, FSCA, and FCA licenses, investor protections, and safety measures to ensure secure trading.

Is Trade.com a Legit Broker with Strong Regulatory Oversight?

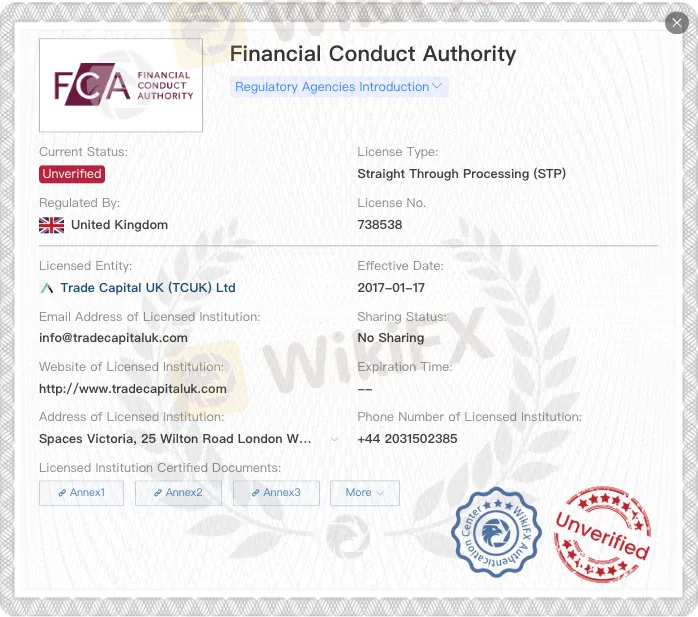

Trade.com operates under multiple financial regulators. The CySEC license (No. 227/14) in Cyprus is fully regulated, confirming the brokers Market Maker status under EU MiFID II rules. This ensures strict capital requirements, client fund segregation, and investor compensation coverage up to €20,000. However, the FSCA license in South Africa (No. 478) is marked as Exceeded, meaning its status is no longer active. Meanwhile, the FCA license in the UK (No. 738538) remains Unverified, which means traders should verify its legitimacy directly with the Financial Conduct Authority before relying on it.

We always assess these details before recommending a broker, and we strongly encourage traders to verify each license on the official regulator websites.

What Safety Measures Protect Client Funds?

Under CySECs oversight, Trade.com must segregate retail client funds from its corporate accounts. This structure ensures that client deposits are shielded in case of insolvency. The broker also implements negative balance protection, preventing traders from owing more than their initial capital during extreme volatility. For added investor security, clients trading under the CySEC entity are covered by the Investor Compensation Fund (ICF), which offers up to €20,000 per eligible account in case of broker default.

From our perspective, the presence of at least one top-tier EU license (CySEC) is a positive sign of reliability, but the FSCA and FCA license statuses raise concerns that should be addressed by the company for full transparency.

FAQs about Trade.com Regulation & Safe

Q1: Is Trade.com broker fully regulated?

A1: Yes, Trade.com holds a valid CySEC license (No. 227/14). However, its FSCA license is expired, and the FCA license is currently unverified.

Q2: Does Trade.com offer investor protection?

A2: Under CySEC, clients receive fund segregation and ICF coverage of up to €20,000 per account.

Q3: What does the FSCA “Exceeded” status mean?

A3: It suggests that the license is no longer valid or has exceeded its operational limits. Always verify with FSCA before engaging the South African entity.

Q4: Can I rely on the FCA license of Trade.com?

A4: Not currently. The FCA license is unverified, and we recommend checking directly on the FCA register.

Q5: How does CySEC regulation benefit traders?

A5: CySEC enforces strict compliance with EU regulations, ensuring client funds are safeguarded, negative balance protection is in place, and transparent trading practices are maintained.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Think Uncle Sam Owes $37 Trillion? It's Far Worse Than That

SkyLine Judge Community: Appreciation Dinner Successfully Held in Malaysia

Currency Calculator