简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Report: Five Forex Brokers with No Spread

Abstract:Zero spread accounts offer traders the opportunity to execute tight, cost-efficient trades. By eliminating the traditional bid-ask spread and charging a small commission per lot, these accounts suit scalpers, high-frequency traders, and strategy-focused investors. In this article, we offer five regulated brokers with strong WikiFX scores. These brokers provide traders with zero-spread accounts.

Zero‑spread accounts offer traders the opportunity to execute tight, cost-efficient trades. By eliminating the traditional bid-ask spread and charging a small commission per lot, these accounts suit scalpers, high-frequency traders, and strategy-focused investors. In this article, we offer five regulated brokers with strong WikiFX scores. These brokers provide traders with zero-spread accounts.

IC Markets (Raw Spread Account)

WikiFX Score: 9.10/10

Regulation: ASIC (Australia), CySEC (Cyprus)

Zero‑Spread Feature: Raw Spread accounts start from 0.0 pips on major currency pairs, with an average EUR/USD spread of 0.1 pips. A commission of USD 3.50 per lot per side applies, delivering ultra-tight pricing ideal for scalping and EAs.

Advantages of IC Markets

- Market Connectivity: Aggregates liquidity from 25+ institutional venues.

- Execution Speed: Servers in Equinix NY4 for minimal latency.

Platform Support: MT4, MT5, and cTrader available.

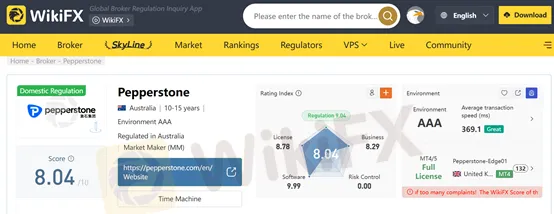

Pepperstone (Razor Account)

WikiFX Score: 8.04/10

Regulation: ASIC (Australia), FCA (UK), CySEC (Cyprus), DFSA (UAE), CMA (Kenya), SCB (Bahamas)

Zero‑Spread Feature: Razor accounts offer raw spreads from 0.0 pips on forex pairs. Commission-based pricing begins at USD 3.50 per 100,000 units on MT4/MT5, ensuring transparent costs for high-frequency traders.

Advantages of Pepperstone

- Global Footprint: Offices in Melbourne, London, Düsseldorf, and beyond.

- Platform Variety: Native app, MT4, MT5, TradingView, cTrader.

- Volume Rebates: Professional clients can earn commission rebates.

Tickmill (Raw Account)

WikiFX Score: 8.93/10

Regulation: FCA (UK), CySEC (Cyprus), FSCA (South Africa), DFSA (Dubai), FSA (Seychelles)

Zero‑Spread Feature: Raw accounts start from 0.0 pips on major FX pairs, with a commission of USD 3.00 per side per standard lot. Ideal for scalpers and algorithmic traders seeking minimal transaction costs.

About Tickmill

- Fast Execution: Average trade execution in 0.15 seconds.

- Client Safety: Negative balance protection and fund segregation.

Education & Tools: Webinars, calculators, and signal center.

FP Markets (Raw Account)

WikiFX Score: 8.88/10

Regulation: ASIC (Australia), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), CMA (Kenya), FSC (Mauritius), SCB (Bahamas)

Zero‑Spread Feature: Raw accounts offer spreads from 0.0 pips on major pairs, with commissions starting at USD 3.00 per lot per side. Leverage up to 1:500 enhances flexibility for active traders.

About FP Markets

- Award‑Winning: Voted Best Value Broker six years running.

- Deep Liquidity: Direct connections to top-tier banks.

- Trading Suite: MT4, MT5, cTrader, Iress, and proprietary tools.

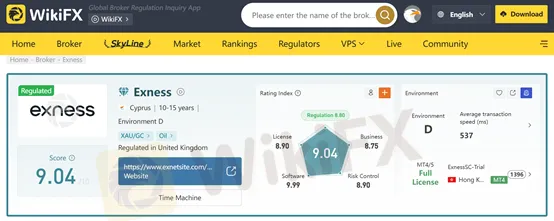

Exness (Zero Account)

WikiFX Score: 9.04/10

Regulation: FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), CBCS (Curacao & Sint Maarten)

Zero‑Spread Feature: Zero accounts deliver 0.0 pip spreads on the top 30 instruments, with commissions from USD 0.05 per side per lot. Market execution with no requotes ensures precision.

Why Choose Exness?

- Unlimited Leverage: Up to 1: Unlimited (subject to local rules).

- Fast Withdrawals: 24/7 automated processing.

Diverse Instruments: Forex, metals, crypto, energies, indices, stocks.

Q&A Section

What are the advantages of a zero‑spread account?

Zero‑spread accounts provide cost certainty, tighter entries, and ideal conditions for scalping and high-frequency trading, as spreads start from 0.0 pips.

Are zero‑spread accounts suitable for beginners?

While the tight pricing benefits all traders, beginners should understand commission models and practice risk management to avoid overleveraging.

Can I use automated trading on zero‑spread accounts?

Yes. All five brokers support EAs and algorithmic strategies on MT4/MT5, with Tickmill and IC Markets offering particularly fast execution.

Conclusion

Choosing a zero‑spread broker with high WikiFX ratings and robust regulation can significantly enhance trading efficiency and risk management. IC Markets, Pepperstone, Tickmill, FP Markets, and Exness each offer compelling zero‑spread accounts.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

SkyLine Judge Community: Appreciation Dinner Successfully Held in Malaysia

On August 1, 2025, the SkyLine Judge Appreciation Dinner was successfully held in Kuala Lumpur, Malaysia. As the first WikiFX SkyLine event in Malaysia this year, the dinner not only aimed to express sincere gratitude to expert judges, partners, and industry representatives who have long supported the development of the SkyLine Judge Community but also facilitated in-depth discussions on the future direction of forex trading safety, financial education, and industry transparency.

AssetsFX Scam Alert: 5 Troubling Signs

Forex trading has become a critical game now because of advancements in technology. Due to this Unfortunately, scam brokers have also entered in the Forex market. Therefore, you need to stay alert. This article aims to warn all traders and investors. Read carefully and stay aware.

Forex4Money: Where Your Money Goes In, But Never Comes Out!

Discover how Forex4Money traps investors with fake profit promises and blocked withdrawals. Read real complaints and protect yourself from this unregulated forex scam.

Forex Success Stories: Lessons You Can Use to Win

There can be many ups and downs even for the world’s best forex traders. However, they remain undeterred in their vision to overcome the challenges that come their way. That’s why they form part of forex success stories that continue to inspire generations. One can inherit some lessons to be among successful currency traders. In this article, we will be sharing the lessons you can use to be successful in forex trading.

WikiFX Broker

Latest News

Euro zone inflation holds steady at higher-than-expected 2% in July

Forex Success Stories: Lessons You Can Use to Win

Scam Alert: FCA Issued Warning! Check the List of Unauthorized Brokers Below!

FCA Forex Trading Regulations Explained – What Every Trader and Broker Must Know

FIBO Group: A Closer Look at Its Licenses

Making Money with Forex Weekend Trading

FCA Issues New Alerts Against Unlicensed Financial Platforms, Including Clone Scams

The Untold Story In Today's Jobs Report: The Unprecedented Purge Of Illegal Alien Workers

Aetos relinquishes FCA license to focus on Australia, offshore

Scam Surge in Sarawak: Losses Soar to RM77.7 Million in Just 7 Months

Currency Calculator