简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The victim is unable to withdraw money both capital and profit after investing in UEZ Markets

Abstract:This article sheds light on the plight of an investor who finds themselves unable to withdraw both their capital and profits after investing in UEZ Markets.

About UEZ Markets

UEZ Markets is a forex broker that was founded in 2018. It is regulated by the Australia Securities & Investment Commission (ASIC, No. 001300519). UEZ Markets offers a variety of trading instruments, including Forex, Metals, Energies, Crypto, and Indices through the MT5 trading platform. This broker does not hold a legitimate license, we could not consider this broker a reliable broker. Thus, we hope all traders understand the risk of investing in this broker.

The Case in Details

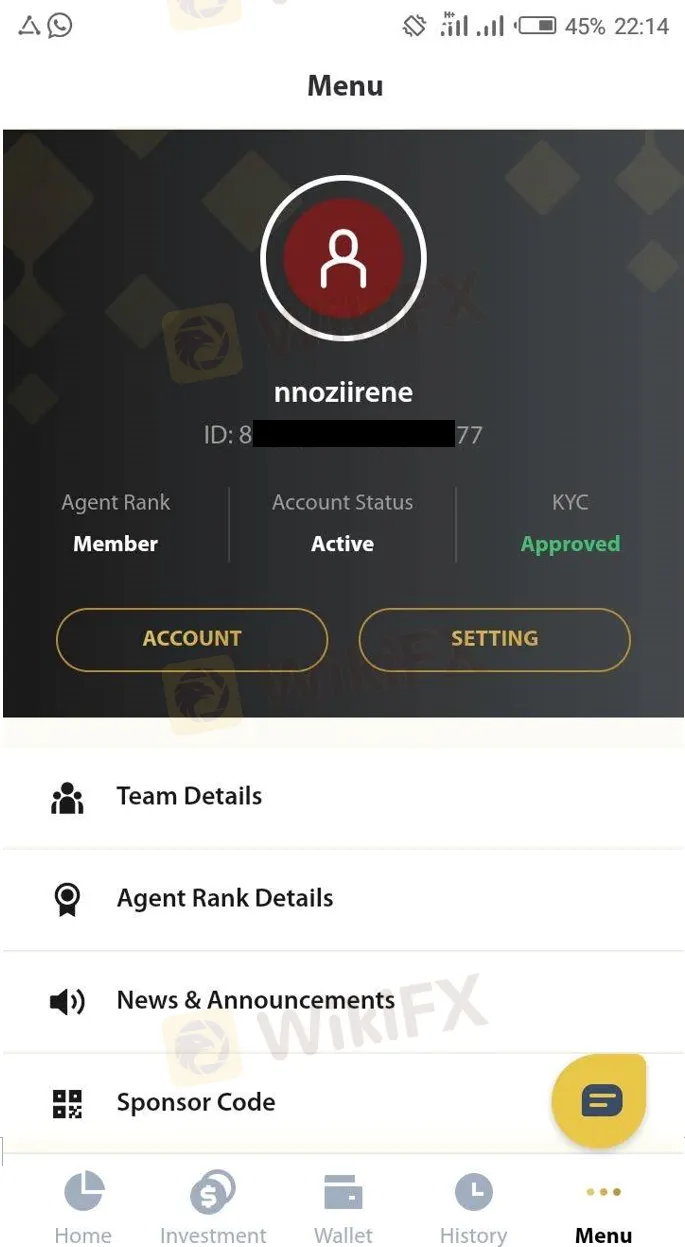

On March 27, 2023, The trader decided to invest $1000 with UEZ Markets, a broker promising consistent monthly profits ranging from 5-6% of the invested capital. The allure of such gains, coupled with the assurance of being able to withdraw both the profits and the initial investment, enticed the victim to take the leap. To legitimize their engagement, UEZ Markets issued investment certificates, labeling them as “Term Managed Account” (TMA), seemingly to establish an air of credibility around their services.

The Red Flag

As time progressed, the victim's investment reportedly yielded profits as promised. With a sense of accomplishment, the investor initiated a withdrawal request to access their accrued profits and capital. To their shock and dismay, UEZ Markets declined the withdrawal request, citing an inability to process the transaction. This red flag sparked concerns about the legitimacy and reliability of the broker, leaving the victim in a state of financial limbo.

Faced with the predicament of being unable to withdraw both the profits and the invested capital, the victim turned to WikiFX for assistance. WikiFX, a platform that provides information and ratings about forex brokers, is often sought after by investors seeking clarity and redress. The victim's hope lies in WikiFX's ability to investigate the matter, potentially helping them recover their invested funds.

Conclusion

Investing is a double-edged sword; it can bring substantial returns, but it also carries risks. The tale of the victims unable to withdraw their capital and profits from UEZ Markets underscores the importance of research, due diligence, and cautious decision-making in the investment realm. It also highlights the necessity for robust regulatory frameworks to prevent instances of fraud and protect investors' rights. As the victim seeks assistance from platforms like WikiFX, the hope remains that they will find a solution to their ordeal and serve as a cautionary tale for others considering similar investment paths.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Silver surges past $33—are you ready for what comes next?

Silver has once again become the center of attention in global financial markets.

171 years! One of this country’s largest crypto-related fraud

A federal court in Brazil has handed down one of the harshest sentences in the country’s history for a crypto-related fraud, jailing three executives of the now-defunct Braiscompany scheme to a combined 171 years behind bars. The case, which saw some 20,000 investors lose approximately R$1.11 billion (about USD 190 million), underscores Brazil’s intensifying crackdown on unregulated cryptocurrency operations

Tradu Joins TradingView for Seamless CFD and Forex Trading

Tradu, a global trading platform, integrates with TradingView for seamless CFD and forex trading, offering transparency, tight spreads, and fast execution.

Protect Your Portfolio in the Storm | What Are Safe Haven Assets?

Gold surged to an all-time high on Tuesday, driven by renewed weakness in the US dollar, ongoing trade war tensions, and critical remarks from President Donald Trump aimed at the Federal Reserve. These factors fuelled strong demand for safe-haven assets, pushing bullion above US$3,485 an ounce for the first time. But what exactly are safe haven assets? Why is everyone raving about them?

WikiFX Broker

Latest News

eXch Exchange to Shut Down on May 1 Following Laundering Allegations

How a Viral TikTok Scam Cost a Retiree Over RM300,000

JT Capital Markets Review

FCA Proposes Simplifying Investment Cost Disclosure for Retail Investors

Fresh Look, Same Trust – INGOT Brokers Rebrands its Website

FCA Issues Alerts Against Unauthorised and Clone Firms in the UK

Consob Orders Blackout of 9 Fraudulent Financial Websites

Tradu Joins TradingView for Seamless CFD and Forex Trading

Japan Issues Urgent Warning on $700M Unauthorized Trades

Silver surges past $33—are you ready for what comes next?

Currency Calculator