简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.S. June Macroeconomic Data Remains Strong — But for How Long?

Zusammenfassung:The U.S. Personal Consumption Expenditures (PCE) data for June remained robust, suggesting that during Q2s tariff suspension period, end consumers continued to frontload purchases. We believe this mom

The U.S. Personal Consumption Expenditures (PCE) data for June remained robust, suggesting that during Q2s tariff suspension period, end consumers continued to frontload purchases. We believe this momentum will likely carry into July—supported by seasonal events such as Amazon Prime Day—yet as we head into August, weakening retail sales will likely return to the forefront of market concerns.

Key Data Points

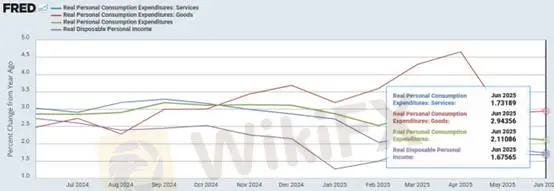

Real goods spending, adjusted for inflation, rose 2.94% year-over-year (vs. 2.88% in May).

Real services spending increased 1.73% year-over-year.

Real disposable personal income rose 1.68% year-over-year.

Overall real PCE posted a steady 2.11% growth rate.

(Chart 1: Disposable Personal Income and PCE — Goods & Services; Source: FRED)

While U.S. households maintained solid spending power in H1 2025—particularly in goods—real disposable income growth slowed to 1.68%. This highlights rising “real income pressure,” which could weigh on savings rates, consumer confidence, corporate revenues, and the broader business cycle in coming quarters.

Beyond consumer demand, corporate inventory levels remain a key risk factor that could trigger a pullback in risk assets. As weve noted before, after a string of bullish catalysts, the market is now facing an environment where upside surprises are becoming increasingly limited.

In financial markets, imagination matters most:

When good news can‘t get any better, equities face correction risk.

When bad news can’t get any worse, equities may quietly form a bottom.

Fed Policy and Market Dynamics

From a monetary policy perspective, the key question is whether equity market corrections will be driven by the Fed keeping rates elevated—or whether market weakness will force the Fed into emergency cuts.

Because monetary policy will heavily influence gold prices, we believe both risks are highly probable and coexist in the near term. This suggests that golds medium-term pullback remains intact, with no clear upside reversal yet. Despite macroeconomic uncertainty, the safe-haven asset of choice remains the U.S. dollar.

The U.S. Dollar Index has already tested the 100 level, fully erasing its June–July losses. Gold remains in a high-volatility consolidation phase, but short-term price action has pushed it below the $3,300/oz psychological level. While U.S. equities have set fresh record highs, gold has yet to revisit its early April post-tariff lows. Investors should note that gold is still relatively overvalued, and downside risk could force a $3,000/oz “defense battle.”

The depth of any pullback remains uncertain. Over the next quarter, the U.S. Treasury will issue a large volume of bonds, while bank reserve requirements will directly impact market liquidity. With tightening expectations—and actual tightening—likely occurring before the Fed cuts rates, we expect liquidity conditions to gradually tighten, creating the most significant headwind for gold.

Gold Technical Analysis

Gold has broken below the key support zone at $3,301. Price action during the Asian session continues to weaken. Traders should watch the $3,262 neckline of the large double-top formation.

If $3,262 holds: Best-case scenario would be high-level consolidation.

If $3,262 breaks: Risk of a structural bear market rises significantly.

Trading bias: Bearish. Avoid a long-biased mindset.

Stop-loss guidance: $15 above entry.

Support: $3,262

Resistance: $3,301 / $3,334

Risk Disclaimer: The above views, analyses, research, prices, or other information are provided solely as general market commentary and do not represent the platforms position. All viewers are solely responsible for their own trading decisions. Please trade with caution.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Wechselkursberechnung